There is sometimes a fine line between a vehicle being considered as a car for VAT purposes and one which is accepted by HMRC as a commercial vehicle. The implication from a VAT recovery perspective is that the opportunity to reclaim VAT on the purchase of a car is extremely limited when compared to the position with commercial vehicles.

Nick Hart, Director, and a member of the firm’s Land and Rural Practice Group says:

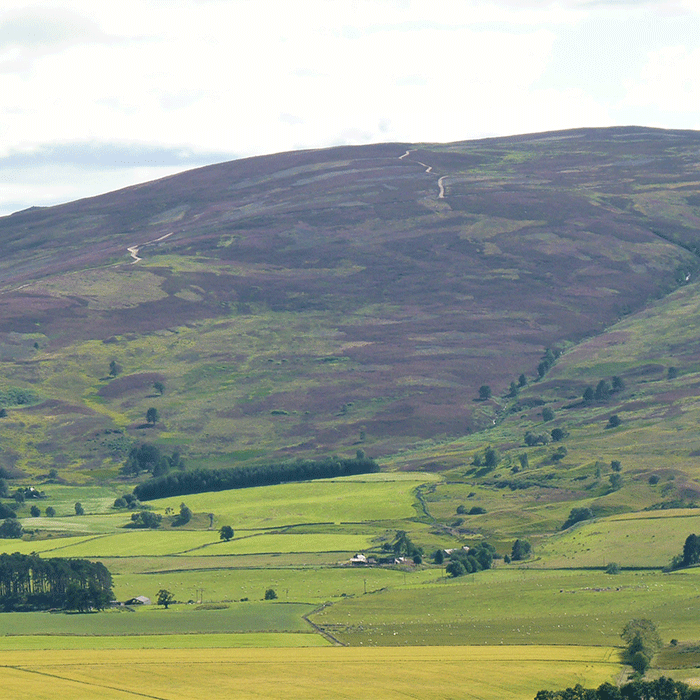

“Particular issues can arise with vehicles such as double cab pick-ups which are extremely popular with rural, farming and estate businesses due to their versatility and suitability for the rural setting. Such vehicles typically are designed to carry passengers, having covered seats behind the driver and front passenger seats. This would be enough for the vehicles to be considered as cars for VAT purposes. However, for those models which are designed to carry a payload of one tonne or more, HMRC accept they are commercial vehicles and not cars from a VAT perspective.”

With respect to cars, VAT recovery is permissible where the vehicle is used exclusively for a business purpose and is not made available for private use.

Nick comments:

“The private use condition here is often misunderstood and the test is not whether a car is actually used for private journeys, but that it is available to use in such a capacity. In practice, a car would need to be a genuine pool car, or private use completely restricted by terms of employment and potentially insurance, for the VAT on purchase not to be blocked from being reclaimed.”

For HMRC to accept that a car is a pool car, there would need to be evidence that the use of the vehicle by employees is controlled and logged, with no exclusive use by any one employee, and that the vehicle is not kept at an employee’s home overnight. Journeys between home and the normal place of employment are private journeys. It is also common for these vehicles to carry business branding and corporate decals and, whilst this is a strong indicator that they are used for business purposes, it does not in itself mean such use is exclusive or that the car is not available for private use.

Nick adds:

“In the case of double cab pick-ups, not all models are designed to carry one tonne or more payloads, and HMRC apply the threshold strictly. Care should therefore be taken to determine what the payload capacity is of these types of vehicle before VAT is reported as recoverable. HMRC will disallow VAT recovery on the purchase of a car, where the business is not able to demonstrate it is not available for private use. Corporate branding on the vehicle does not sway their view in this respect.”

There is more opportunity to reclaim VAT on the purchase of commercial vehicles including double cab pick-ups which have a payload of one tonne or more and HMRC accept that minimal or incidental private use does not prevent all of the VAT paid to be reclaimed, subject to the other normal VAT recovery conditions. Businesses should however expect scrutiny on whether the vehicle is a car rather than a commercial vehicle, and also whether the business use can be evidence for either a car or a van.

Advice should be taken when considering a purchase – for any further queries please get in touch with Nick Hart.

Contact us

Partner, Bristol

Key experience