Following the introduction of EU CBAM in 2023, the UK government is set to introduce its own Carbon Border Adjustment Mechanism (CBAM) from 1 January 2027. UK CBAM will place an additional tax compliance burden, and potentially a tax cost, on businesses that trade in certain imported goods. It is therefore important to check if your business will be affected and start preparing for the implementation of CBAM.

What is the UK Carbon Border Adjustment Mechanism?

The UK Carbon Border Adjustment Mechanism (CBAM) will place a tax on the imports of certain emission intensive goods into any part of the UK from countries with a lower or no carbon price. The tax will be based on the carbon emissions generated in the production, adjusted to reflect the gap between the carbon price (the tax or equivalent paid) applied in the country of manufacture and the carbon price (tax due) applied in the UK.

Why is the UK Carbon Border Adjustment Mechanism being introduced?

The global approach to addressing carbon emissions is changing, with most major economies taking steps to decarbonise. As part of the UK’s commitment to reach net zero by 2050, the government has introduced regulations and rules, such as the UK Emissions Trading Scheme (UK ETS), which incentivises businesses to decarbonise by imposing a cost on carbon emissions. However, imported goods are not subject to the UK ETS, which can lead to variances in carbon pricing across the UK market.

With domestic emission regulations getting tougher, emission intensive companies may look to shift their operations to countries with more relaxed emissions laws. This will lead to ‘carbon leakage’– which remains a big piece in the puzzle to reach global net zero targets. A co-ordinated international approach would be needed to mitigate the risk of carbon leakage, but given that this will take time, and in line with the EU implementing its CBAM, the UK government has decided to introduce its own CBAM.

How will the UK Carbon Border Adjustment Mechanism work?

Based on the draft legislation and accompanying explanatory notes published on 24 April 2025, this is what we know so far about how CBAM will work.

CBAM will place a carbon price on the most emission intensive industrial goods imported into the UK from the following sectors:

These ‘CBAM goods’ will be identified by commodity codes.

Products from the ceramic and glass sectors will not be in scope of UK CBAM from 2027, as had initially been proposed, but will be considered for future inclusion.

CBAM will only apply to ‘CBAM goods’ which are imported in the course of business and any goods imported for non-business purposes will be outside of scope. CBAM liability will be calculated by reference to ‘direct’, ‘indirect’ and select ‘precursor’ product emissions, referred to as ‘embodied emissions’ in ‘CBAM goods’.

HMRC will set a CBAM rate for each CBAM sector based on the effective carbon price in the UK, which is the price paid by the producers after accounting for the impact of free allowances and other reductions. The aim is to ensure that imported goods are subject to a carbon price comparable to that incurred by UK production.

Imported scrap products will be excluded from UK CBAM. Partly because the risk of carbon leakage from using such products as input materials is low, and it would be difficult to distinguish between pre- and post-consumer scrap.

Calculating UK CBAM liability

There will be two options to determine emissions embodied within imported goods for calculating UK CBAM liability. The liable person will be able to either:

- Use independently verified data on the actual emissions embodied within CBAM goods; or

- Use default values set per product by the government (the initial default values will be published ahead of 1 January 2027).

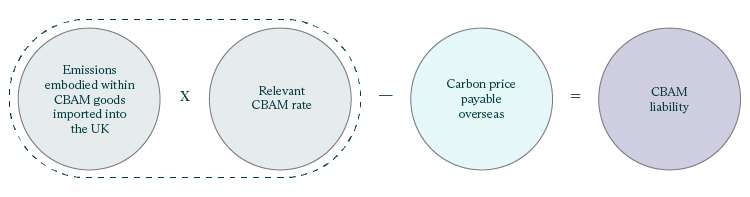

HMRC will set quarterly CBAM rates for each sector within the scope of CBAM. CBAM liability will then be calculated by multiplying the CBAM rate by the embodied emissions and deducting any overseas carbon prices that have already been paid (to avoid double taxation). The calculation can be summarised as follows:

The tax point for determining the CBAM liability will depend on whether goods are subject to customs control. If they are, the tax point will be the date on which the goods are released. If not, the tax point will be the date the goods first enter the UK.

The ‘liable person’ for CBAM will be either the person responsible for goods when they are released into free circulation (if subject to customs controls) or the person on behalf of whom the goods are imported (if not subject to customs controls).

The ‘liable person’ must register with HMRC for CBAM if either the aggregate value of CBAM goods in the previous 12 months was £50,000 or more or it is expected to be more than £50,000 in the next 30 days. This threshold has been increased from the original proposal of £10,000.

Similar to VAT grouping, certain connected companies will be able to apply for group treatment, so that one company (the representative member) is responsible for submitting CBAM returns and paying the CBAM liability on behalf of the entire group.

Carbon price relief can be claimed to reduce the CBAM liability where overseas carbon prices have previously been paid on the embodied emissions. The onus will be on the taxpayer to have verified evidence of any carbon price deductions claimed, including for their supply chain where they didn’t produce the goods. The evidence must show that a liability has been incurred, but not necessarily that the amounts have already been paid. The government is to provide more detail about the verification of deductible carbon prices.

Administration of the UK CBAM

The first CBAM return will be for the 12 months from 1 January to 31 December 2027 and the return and any payment will be due by 31 May 2028. The draft legislation provides that from 1 January 2028 CBAM accounting periods will be based on calendar quarters with returns and payments due on the last working day of the second month after the end of the accounting period. HMRC has the power to change the accounting periods and deadlines and has said it may do so for the first quarterly accounting periods to support businesses with the transition to quarterly accounting.

Businesses that are liable to the CBAM will need to submit CBAM returns for each prescribed accounting period, even if the liability to the CBAM is nil. Businesses will be able to deregister if they are incorrectly registered, or if they have not met the CBAM registration tests in the previous 12 months The government has confirmed that tax agents will be able to submit CBAM returns on behalf of liable persons. There are no plans for a CBAM deferment scheme.

Penalties will apply for compliance errors, for example, failure to register for the CBAM, failure to submit CBAM returns and failure to keep records. The plan is use existing HMRC powers and penalties, including a general regulatory penalty for offences that are specific to the UK CBAM. The government is looking to align with the VAT penalty points system as far as possible for late submission of CBAM returns and late payment.

Are you affected by the Carbon Border Adjustment Mechanism?

If you’re a UK business importing emission intensive industrial goods into the UK for business purposes, you may fall within the scope of CBAM. Affected businesses must consider the impact of the additional reporting requirements, and the cost of charges levied on them under CBAM, and plan accordingly. Businesses may also wish to consider reviewing supply chain models in advance of implementation to mitigate the potential CBAM liability.

How we can help

The introduction of CBAM will present challenges for those operating within the affected sectors, and preparing for the changes is vital.

We can support you in the following ways:

- Reviewing the goods currently being imported by reference to the commodity codes within scope of CBAM,

- Assessing the potential CBAM liability and registration requirements,

- Assisting with developing an internal processes and systems readiness for the implementation of CBAM, and

- Providing insights from government departments whom we are liaising with.

If you have any questions or would like to discuss how CBAM may affect your business, please get in touch.

Contact us

Partner, Edinburgh

Key experience