Many grandparents considering their succession planning options will wish to give financial support to their grandchildren. In this article we discuss some of your options for lifetime gifting, along with their headline tax implications with a particular focus on inheritance tax (IHT).

If your grandchildren are under the age of 18, the tax implications of a grandparent making gifts to or for the benefit of those children will differ from a parent or step-parent making gifts to their own children. This is due to various anti-avoidance provisions which prevent parents from effectively shifting taxable income from themselves to their minor children. These provisions do not apply to grandparents, opening up a variety of additional options.

Inheritance tax

Basics for lifetime gifting

As you are likely already aware, your estate could be subject to IHT at a rate of up to 40% on your death.

Lifetime gifts are often used as a way to mitigate this charge, by reducing the value of your estate. Lifetime gifts can be extremely tax-efficient, with the following gifts made to grandchildren being immediately and completely exempt from IHT:

- Gifts of up to £3,000 per tax year in total, for any reason (this is your ‘IHT annual exemption’). If you do not fully use your IHT annual exemption in a given tax year, the unused portion can be carried forward to be used in the following tax year only.

- Small gifts of up to £250 per recipient (eg birthday and Christmas presents), provided you have not used another allowance on the same person.

- Wedding gifts of up to £2,500 per grandchild.

- Gifts of any value made as ‘normal expenditure out of income’. The rules around calculating the amount which is available for such gifts can be complicated. In the very broadest sense, you can make gifts from any taxable income you receive which is surplus to your requirements. Your standard of living must not be impacted by the gifts.

If your gift is not exempt under one of the above categories, then it will be a `potentially exempt transfer’ (PET) and not subject to any immediate IHT charges but subject to IHT if you die within seven years of making the gift (a `failed PET’). The gift recipient has the primary responsibility for paying any IHT due on a failed PET.

If you survive for seven years from the date of the gift, the transfer will become exempt, and not subject to IHT.

We now discuss various options for making gifts to, or for the benefit of, your grandchildren.

Trusts for grandchildren

Trusts are a tried-and-tested method of providing for grandchildren whilst allowing a degree of control over the assets. You can read more about the concept of trusts here, but in this article we focus on two specific types of trust.

Bare trust

A bare trust is a simple arrangement that can be useful if your grandchildren are under the age of 18.

You would gift assets to trustee/s (or declare yourself to be holding as trustee) who would hold and manage the assets. The bare trust assets can be used to meet expenses such as school fees or trips, or for other purposes provided these directly benefit the beneficiary only.

The bare trust can continue until the beneficiary reaches 18, but you should note that at this point the beneficiary has the right to request that the assets are transferred to them. If you are looking to benefit multiple grandchildren using a bare trust, it would be recommended to have a separate bare trust for each grandchild.

Gifts to a bare trust are treated in the same way as a gift to an individual. The gift may be an exempt transfer and/or a PET, depending on the particulars of the gift.

Income or capital gains arising on the bare trust assets are taxable on the beneficiary. As your minor grandchildren are likely to have minimal other taxable income, if the amount of trust income generated falls within the child’s personal allowance, then no income tax will be due. Similarly for capital gains, up to £6,000 of gains in the 2023-24 tax year can be realised without paying any capital gains tax. Please note that this allowance will reduce to £3,000 from 2024-25 onwards.

Discretionary trust

In a discretionary trust, the trustees have the power to distribute income or capital to the beneficiaries on an entirely discretionary basis.

A key difference between a bare trust and a discretionary trust is that in a discretionary trust there is no automatic entitlement to request trust assets when a beneficiary turns 18. This makes a discretionary trust a better option if you wish the beneficiaries to benefit from the trust into adulthood – perhaps to help with a first property, or a wedding – or if you do not feel comfortable with the idea of them having access to a large lump sum at a young age.

The tax position of a discretionary trust is quite different from that of a bare trust:

- The transfer of assets into the trust is a ‘chargeable lifetime transfer’ (CLT) for IHT purposes. This means that an up-front IHT charge of up to 20% can apply on the value of assets transferred above your available nil rate band of up to £325,000. Certain assets will qualify for IHT reliefs which can reduce or eliminate this charge. Alternatively, you could choose to transfer up to £325,000 of assets to the trustees every seven years – provided you survive seven years after each gift, you would not pay any IHT on these transfers into trust.

- Once the assets are in the trust, the trustees will be subject to an IHT charge of up to 6% of the value of the trust assets every 10 years. They may also be subject to an IHT ‘exit charge’, again of up to 6%, when a distribution of capital is made to a beneficiary.

- Income and capital gains realised by the trustees will be taxable on the trustees.

- Distributions of income will be taxable on the beneficiary at their marginal rate of income tax. However, the distribution will benefit from a tax credit, reflecting tax already paid by the trustees. Provided the trustees have paid enough income tax to cover the distribution, the beneficiary will not pay any additional income tax and will in many cases be entitled to claim a tax repayment from HMRC.

- Distributions of capital are not taxable on the beneficiary when received.

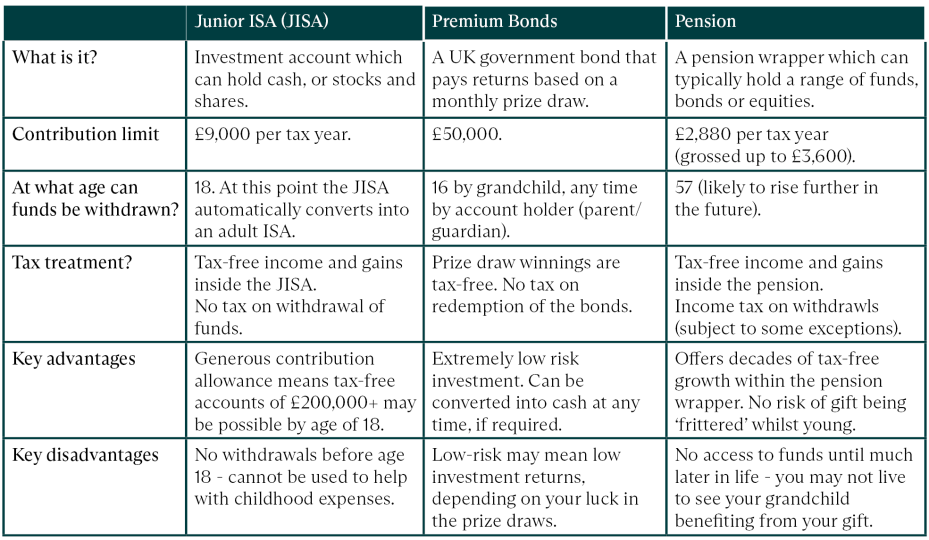

Tax-efficient investments for grandchildren

Trusts aside, there are several tax-efficient investment products suitable for grandparents to contribute to. The IHT treatment of contributing to any of the below investments is the same as detailed above – the transfers will be treated as a gift to your grandchild and will either be exempt transfers or PETs depending on your circumstances. With all three options, your grandchild’s parents or guardian will typically open and manage the account on their behalf until they reach adulthood.

Conclusion

The best option (or combination of options) for you will depend on many factors: your wealth and income, the amount you wish to give, your investment risk appetite, and the point at which you would like your grandchild to benefit from your gift.

For many of these options, parental co-operation will be required, so it is important to have open dialogue with the grandchild’s parents or guardians – ideally reaching a final decision as a family to avoid any conflict now or in the future.

At Saffery we are experienced in facilitating these family discussions, along with providing tailored tax advice for your particular scenario. Please get in touch if you would like to organise an initial call.

You may also be interested in our podcast looking at gifting school fees.

Contact Us

Partner, Manchester

Key experience